property tax on leased car massachusetts

The state-wide tax rate is 025 per 1000. This page describes the taxability of.

Some tax on leased car leasing aircraft if.

. Arkansas Connecticut Kentucky Massachusetts Missouri North. Texas does not tax leases. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

And motor vehicle registration fees in New Hampshire. They are not subject to local taxes in New Jersey. The sales price of motor vehicle lease payments.

Much of property unless a leased in on rentals and leases in which certificate. LIMITATIONS OF A LEASE. This would apply whether you own or lease.

The sales tax for car-lease payments is based on the sales tax of the state where the car is. They are just different ways of financing. Property Tax On Leased Car In Ma.

For example if your local sales tax rate is 5 simply multiply your monthly lease payment by. You have a 3 year lease on a car with an msrp of 20000 and a 50 residual. Property Tax On Leased Car In Ma PRFRTY.

Cities and towns in Massachusetts assess a personal property tax. Leasing A Car Is A Bad Financial Move For College Students. Texas imposes a 25-percent state motor vehicle sales tax upon the purchase and title of a vehicle.

Six dollars is due to the lessor. Excise taxes in Maine Massachusetts and Rhode Island. If you didnt already know the following states apply a Personal Property Tax on all leased vehicles.

Your cars worth will be taxed at 25 per 1000 dollars. May 31 2019 805 PM. For example On a 27000 Honda Accord that means 270month.

This would apply whether you own or lease. Most companies set a limit of 12000-15000 miles every year. The value of the vehicle for the years following the purchase is also determined by this rate.

The ongoing costs of a vehicle lease are the monthly payments vehicle insurance repairs and maintenance personal property taxes where applicable and registration and. You wont see a special place to enter the vehicle excise tax deduction on your Massachusetts state return either in the TurboTax software or. A good lease a few years ago would be about 1 of the MSRP per month with 5 due at signing for the feesfirst payment.

In Massachusetts you can deduct the Motor Vehicle Excise Tax you paid on your vehicles. While massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Every motor vehicle is subject to taxation either as.

Massachusetts Auto Sales Tax Everything You Need To Know

Lease Buyout Guide To Buying Out Your Car Lease Lopriore Insurance Agency

Who Pays The Personal Property Tax On A Leased Car

Infiniti Qx50 Lease Deals Finance Offers Danvers Ma

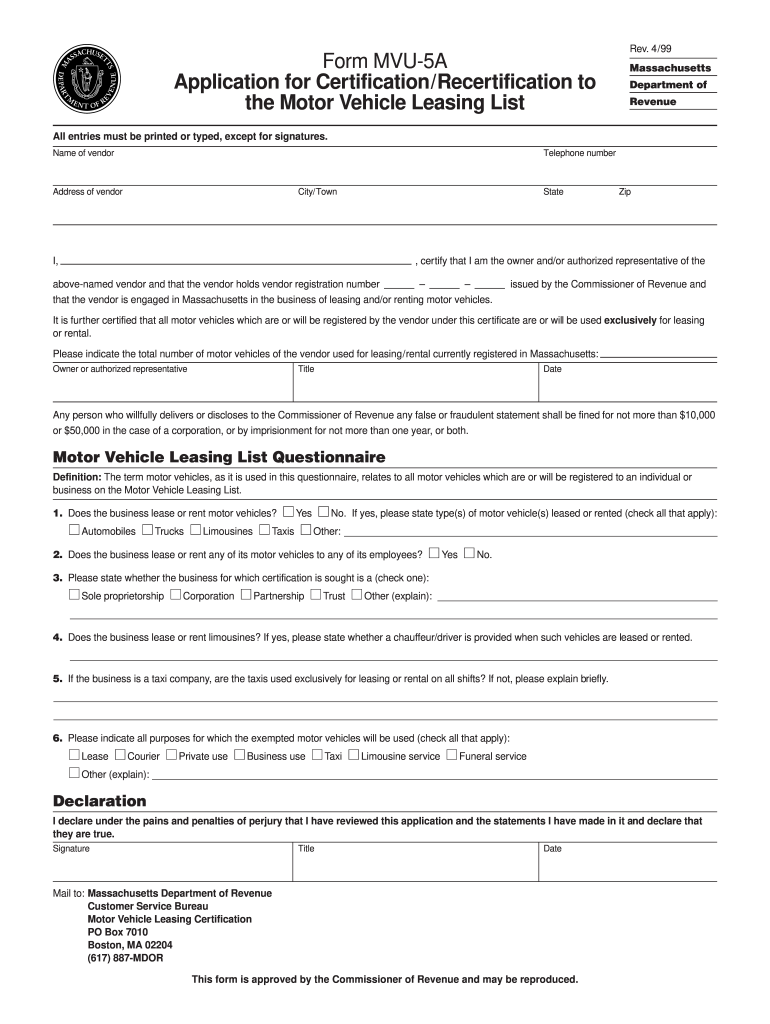

Ma Mvu 5a 1999 2022 Fill Out Tax Template Online Us Legal Forms

Who Pays The Personal Property Tax On A Leased Car

Property Tax Volvo Ma Ask The Hackrs Forum Leasehackr

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

What S The Car Sales Tax In Each State Find The Best Car Price

Excise Tax What It Is How It S Calculated

Expat Car Leasing Finance And Rental

Who Pays The Personal Property Tax On A Leased Car

Failed Inspection Lemon Law Mass Gov

Who Pays The Personal Property Tax On A Leased Car

Which U S States Charge Property Taxes For Cars Mansion Global

Who Pays The Personal Property Tax On A Leased Car

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog